Find Someone’s Social Security Number: Understanding Legal Access and Privacy Concerns

Social Security Numbers (SSNs) are a critical component of identity and record-keeping for individuals within the United States. The nine-digit number functions not just as

How Can I Get Someone’s Social Security Number: Legal Reasons and Proper Channels

Obtaining someone’s Social Security Number (SSN) is a process regulated by federal laws and involves ensuring the right to privacy and protection against identity theft.

How Can I Find Someone’s Social Security Number: Understanding the Legal Framework

For many people, a Social Security Number (SSN) is a crucial piece of identification used for various legal and financial purposes. Obtaining someone else’s SSN

Can You Find Someone by Their Social Security Number: Understanding the Possibilities and Limits

Locating individuals by their Social Security Number (SSN) is a topic that intertwines legality, privacy, and the potent reach of contemporary data management. SSNs were

How to Find Social Security Number of Someone: A Guide to Legal Compliance and Privacy Concerns

Finding someone’s Social Security Number (SSN) is a task that requires a great sense of responsibility and strict adherence to legal standards. As it is

Understanding the Legalities of Accessing Social Security Numbers

Social Security numbers (SSNs) are integral to the fabric of American identity and bureaucracy, serving as a primary identification for residents within the United States.

How to Find Someone by Their Social Security Number: A Guided Approach

Locating someone by their Social Security number (SSN) is a task often necessitated by various legal or business requirements. An SSN is a unique identification

Understanding Legal Scenarios for Accessing Someone’s Social Security Number

Obtaining someone’s Social Security Number (SSN) is a process that is strictly regulated by federal law, given the sensitivity and importance of this unique identifier.

Understanding Eligibility for Accessing Social Security Numbers: Legal and Privacy Considerations

Understanding Eligibility for Accessing Social Security Numbers: Legal and Privacy Considerations In today’s digital age, locating a person’s Social Security Number (SSN) can be a

Find Someones SSN Today

Finding another person’s Social Security Number (SSN) can be a delicate and often complex process, typically permissible only under specific legal circumstances. SSNs are sensitive

Unveiling the Legitimate Ways to Obtain Someone’s Social Security Number

Facebook Twitter Youtube Pinterest Yelp Legally Obtain Someone’s Social Security Number for Valid Purposes Introduction In today’s interconnected world, obtaining information has become crucial for

How to Get Someone’s Social Security Number After Death: A Guide for Legal Purposes

Obtaining a deceased person’s Social Security number (SSN) is sometimes necessary for handling their final affairs, including managing estate issues or claiming benefits. After someone

How to Safely Find Information Online: Understanding the Risks of Social Security Number Searches

Facebook Twitter Youtube Pinterest Yelp Table of Contents Introduction Is It Legal to Search for Someone Else’s Social Security Number? The Dangers of Obtaining Personal

Public Records Social Security Number

Public Records Social Security Number. How to find someone’s social security number from public records. Share on facebook Facebook Share on twitter Twitter Share on

How To Use Someone’s SSN To Get Money

How To Use Someone’s SSN To Get Money? Social Security Numbers ARE NOT Public Records And Should Be Kept Secure And Private. Social Security Numbers

How To Collect Small Claims Judgment California

Share on facebook Facebook Share on twitter Twitter Share on linkedin LinkedIn How To Collect Small Claims Judgment California My name is Lance and I

How Can I Issue a 1099 Misc to a Contractor Without Their Social Security Number

Share on facebook Facebook Share on twitter Twitter Share on linkedin LinkedIn How Can I Issue a 1099 Misc to a Contractor Without Their Social

When will I Receive my Replacement Social Security Card

When will I receive my replacement social security card? The online Social Security replacement card processing time is 6 to 10 business days. On very

What Measures Does Social Security use to Ensure My Information in the Online Replacement Card Application is Secure

Share on facebook Facebook Share on twitter Twitter Share on linkedin LinkedIn What measures does Social Security use to ensure my information in the online

How do you Apply for a Replacement Social Security Card Online

How do you apply for a replacement Social Security card online? Log into your my Social Security account.Navigate to the “My Home” tab and then

How To Find Social Security Number of Deceased Parent?

You can make a request for a copy of a deceased person’s original Application for a Social Security Card (SS-5) and/or Numident record (a computer

How Can I Verify Employees’ Social Security Numbers

Share on facebook Facebook Share on twitter Twitter Share on linkedin LinkedIn Share on whatsapp WhatsApp How can I verify employees’ Social Security numbers? There

Who Lives At Address And How To Contact Them

Do you need to contact the owners or residents of a specific address? Finding out who lives at address and contacting them can be easy

Who is The U.S. Social Security Administrations External Data Source For ID Verification

Share on facebook Facebook Share on twitter Twitter Share on linkedin LinkedIn Share on whatsapp WhatsApp The U.S. Social Security Administration uses an external data

How To Use Cash App to Buy Someone’s Social Security Number?

We Only Accept Cash App Payments & Bitcoin Payments. What is Cash App? Cash App is a mobile payment service developed by Square, Inc., allowing

What Is A Social Security Number?

What Is A Social Security Number? A social security number is a nine-digit number that the United States government usually issues to all its citizens.

How Easy Is It To Use The SSN Validator

If you would like to validate a Social Security number, there are several ways that you can do this. How To Find Someone’s Social Security

How To Get Social Security Number And Benefits Of Your Ex-Spouse.

You have gone through a divorce, and you and your spouse and now living separate lives. This can be a tricky period for any couple,

How To Do A Quick SSN Lookup

Are you interested in looking up the history of someone, or even yourself, using a Social Security number lookup service? This is provided for free

Can I Request a Replacement Social Security Card Online if I am a Naturalized Citizen

Share on facebook Facebook Share on twitter Twitter Share on linkedin LinkedIn Share on whatsapp WhatsApp Can I request a replacement social security card online

How To Pay For Online Investigations?

My name is Lance Casey and I am a private investigator. For over the past 20 years I have been finding Social Security Numbers and

How To Find Social Security Number by Name And Date Of Birth (DOB) For Free?

How To Find Social Security Number by Name And Date Of Birth (DOB) For Free? Complete the form below to find someone’s social security number

How To Find Social Security Office Near Me -Social Security Number Look Up

How To Find Someone’s Social Security Number Fullz for Sale Private Investigator Process Server California Secretary of State CA SOS Secretary of State Service of

How To Find An Address With A Social Security Number?

How To Find Someone’s Social Security Number If you have been trying to verify an individual or find out where they may have gone, their

How Do I Prove My FCRA Permissible Purpose To Get Someone’s Social Security Number Online?

How Do I Prove My FCRA Permissible Purpose To Get Someone’s Social Security Number Online? How To Find Someone’s Social Security Number? Provided your subject

How To Find Assets With Social Security Number?

How To Find Assets With Social Security Number? The idea that one can casually check another person’s assets such as brokerage and bank accounts through

I Need A Social Security Number – How To Find Social Security Office Near Me?

How To Find Someone’s Social Security Number Fullz for Sale Private Investigator Process Server California Secretary of State CA SOS Secretary of State Service of

How To Find Out Who A Social Security Number Belongs To?

How To Find Out Who A Social Security Number Belongs To? Fullz for Sale Private Investigator Process Server California Secretary of State CA SOS Secretary

How To Choose Reverse Social Security Number Lookup Services

How To Find Someone’s Social Security Number Are you currently searching for a company that could help you locate a Social Security number? Perhaps you

HOW TO BUY CREDIT CARD NUMBERS ON THE DARK WEB

Lance Casey, Private Investigator finds 1000 websites with credit card numbers that work. buy credit card numbers on the dark web. The online term

How To Find An Address Using Social Security Number?

An individual’s social security number is the key to getting most of their details. It can give details such as their address, driver’s license and

What is a Social Security Number Trace?

How To Find Someone’s Social Security Number

How To Get A New Replacement Or Corrected Social Security Card

I get calls daily from people who are trying to get a replacement Social Security Card. How To Find Someone’s Social Security Number. I am

How To Find Out Who a Social Security Number Belongs To Information?

How To Find Out Who a Social Security Number Belongs To Information? Anyone that is a citizen of the United States will have a Social

How To Find Someone’s Social Security Number Today?

How To Find Someone’s Social Security Number Today? Complete the form below to find someone’s social security number You will receive an email with instruction

Social Security fumbles duty to help widows maximize benefits

How To Find Someone’s Social Security Number Information? Complete the form below to find someone’s social security number You will receive an email with instruction

How To Do A Quick Social Security Number Lookup

Looking up someone’s Social Security number is not as hard as you would imagine. There are many websites online that can help you find this

How To Find Bank Accounts By Social Security Number?

Fullz for Sale Private Investigator Process Server California Secretary of State CA SOS Secretary of State Service of Process Most of us are tagged with

Find Someone By Social Security Number

A social security number is something that should be kept at close range and should be heavily guarded, however most companies or organizations may require

Lookup SSN by Name for Judgment Recovery

Complete the form below to find someone’s social security number You will receive an email with instruction on how to pay using Cash App or

Lookup SSN by Name for debt collection

Complete the form below to find someone’s social security number You will receive an email with instruction on how to pay using Cash App or

Here’s How To Find Social Security Number Office Near Me

Sooner or later, a person may need to get info on a Social Security Number. This might mean they have to go to an office

How To Find Someone’s Social Security Number Information?

How To Find Someone’s Social Security Number Information? Complete the form below to find someone’s social security number You will receive an email with instruction

How To Use Bitcoin To Get Someone’s Social Security Number?

What is Bitcoin? Bitcoin is a cryptocurrency. It is a decentralized digital currency without a central bank or single administrator that can be sent from

What is a Social Security Number Information?

What is a Social Security Number Information? Everyone has a Social Security Number. The Social Security Number or SSN is a way to identify each

How To Order A Social Security Number Lookup Search?

If you were born in the United States, then it’s extremely likely that you have a social security number(SSN). And if you don’t, then you

Can You Buy SSN Online?

Buy SSN Online Buy someones full name, SSN, birth date, telephone history & address history. The SSN is a personal identifier that you can use

How To Find Bank Accounts By Social Security Number 2019?

How To Find Bank Accounts By Social Security Number? Fullz for Sale Private Investigator Process Server California Secretary of State CA SOS Secretary of State

Credit Card Hacking Investigation

My name is Lance Casey and I am a license California private investigator. One of the services that I provide to my clients is to

How to Find a Deceased Person’s Social Security Number?

How to Find a Deceased Person’s Social Security Number? There are a multitude of reasons you may need to find the social security number of

How to Find a Deceased Person’s Social Security Number Information?

Fullz for Sale Private Investigator Process Server California Secretary of State CA SOS Secretary of State Service of Process When a person dies, sometimes their

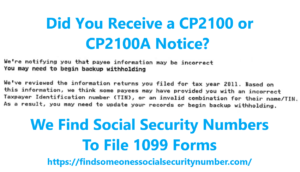

How to get an independent contractor’s correct taxpayer identification number (TIN), social security number (SSN).

Did you receive a CP2100 or CP2100a notice from the IRS? I am a private investigator and I can get their social security number from